Table of Contents

- Catch-Up Contributions Into a Roth 401(k) Isn't a Bad Idea | Kiplinger

- Catch-Up Contributions Into a Roth 401(k) Isn't a Bad Idea | Kiplinger

- Retirement Contribution Limits for 401K, IRA, Roth IRA & IUL

- Maxing Out 401(k) & Roth IRA Plans | Limits, Benefits & What Is Next

- Roth Ira Contribution Limits 2024 Catch Up Over 50 - Enid Jesselyn

- Contribution Limit Increases For Tax Year 2025 For 401(k)s and IRAs ...

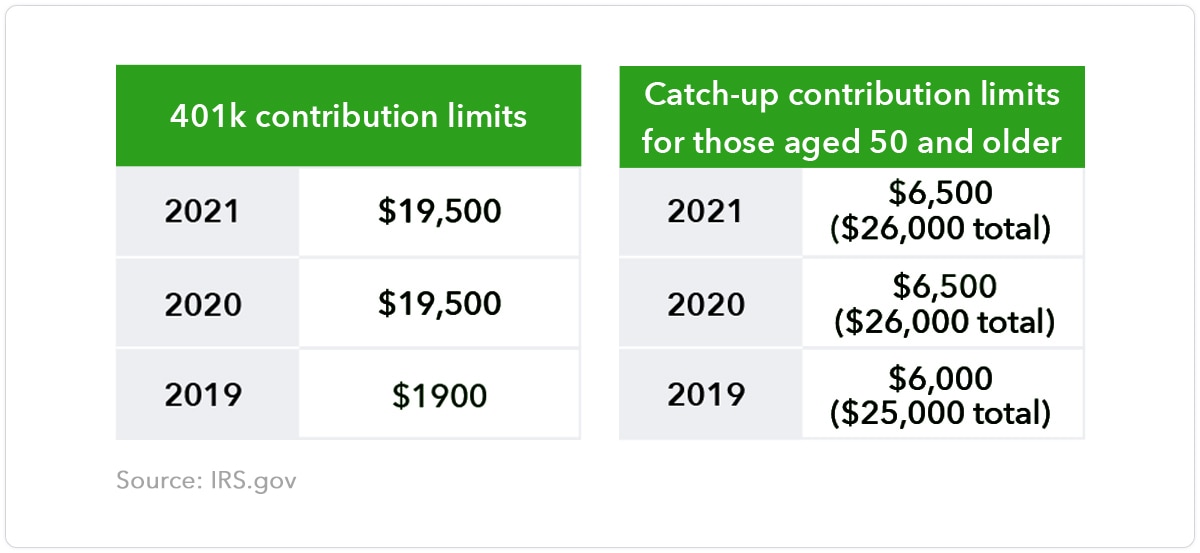

- These are your 2021 401(k) and IRA Contribution Limits

- 401(k) Contribution Limits In 2024 And 2025 | Bankrate

- Retirement plans are changing in 2025: What to know - ABC News

- 2025 Max 401k Contribution Limits Employer - Natalie Sequeira

_and_Roth_IRA_Plans.png?width=1920&name=Things_to_Consider_Before_Maxing_Out_401(k)_and_Roth_IRA_Plans.png)

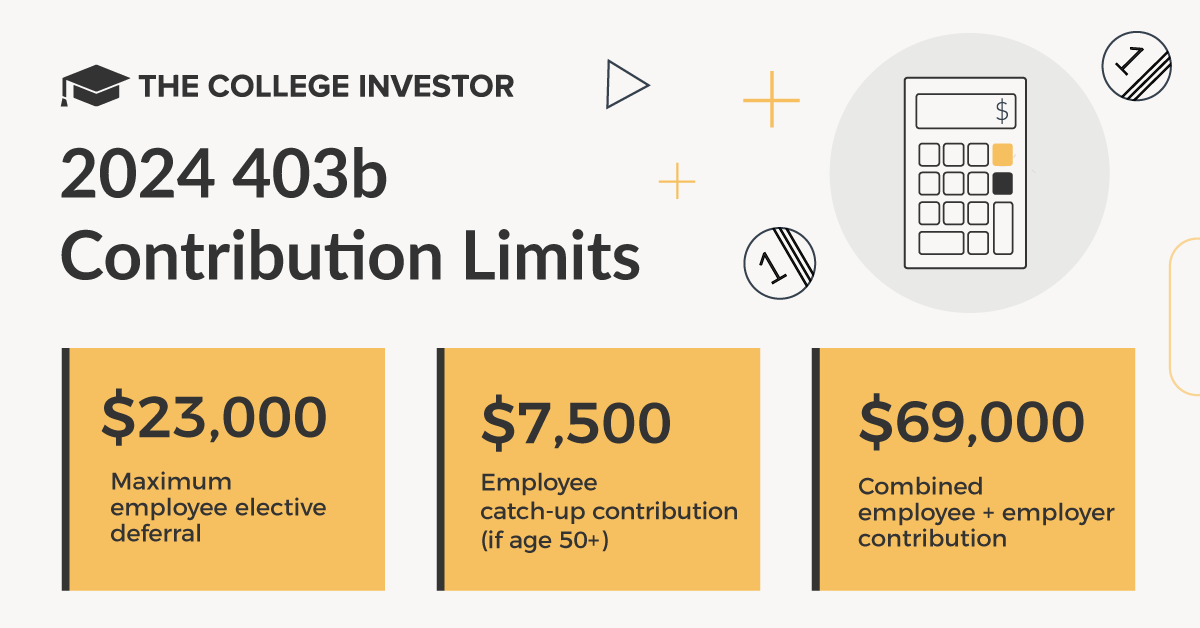

2025 401(k) Contribution Limits: What's Changing?

Key Updates and Considerations

What to Do Next

To maximize your 401(k) contributions in 2025, consider the following steps: 1. Review your budget: Assess your income and expenses to determine how much you can afford to contribute to your 401(k) plan. 2. Adjust your contributions: If you're not already contributing the maximum amount, consider increasing your contributions to take advantage of the higher limit. 3. Consult with a financial advisor: If you're unsure about how to optimize your 401(k) contributions or need help with retirement planning, consider consulting with a financial advisor. 4. Take advantage of catch-up contributions: If you're 50 or older, don't forget to take advantage of the catch-up contribution limit to boost your retirement savings. In conclusion, the 2025 401(k) contribution limits offer a great opportunity to maximize your retirement savings. By understanding the key updates and considerations, you can take advantage of the increased contribution limits and make the most of your 401(k) plan. Remember to review your budget, adjust your contributions, and consult with a financial advisor if needed. With a solid retirement savings strategy in place, you can secure a more comfortable and financially stable future.By following these tips and staying informed about the latest updates on 401(k) contribution limits, you can make the most of your retirement savings and achieve your long-term financial goals.